This is in accordance with the implementation of a consensus-based solution that has been agreed upon by 132 of the 139 countries or jurisdictions of the Organisation for Economic Co-operation and Development (OECD) members /G20 Inclusive Framework on Base Erosion and Profit Shifting (BEPS).

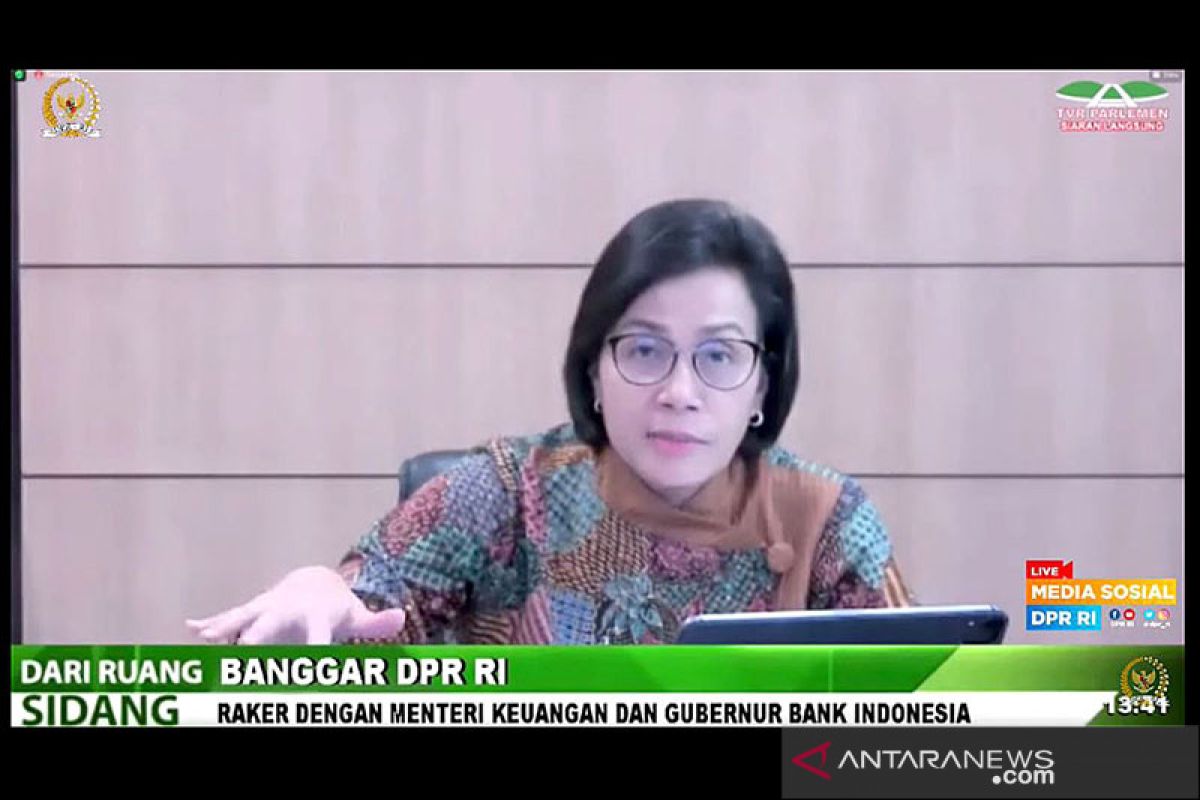

"This agreement is a historic development that will change the platform or architecture of international taxation," the minister noted in Jakarta, Monday.

Indrawati pointed out that Indonesia's potential to obtain the allocation of taxation rights is included in the first pillar of this international tax agreement.

Moreover, the minister noted that this agreement also had a second pillar that focuses on the global minimum tax for equitable distribution of the international tax system, specifically the agreed global minimum tax rate of 15 percent.

Indrawati expounded that the agreement demonstrates the ability of a multilateralism approach to overcome global challenges, especially related to BEPS and unfair tax rate competition.

The minister noted that for Indonesia, the agreement resulting from this major effort is important since it is in line with tax reform as proposed in the bill on the general provisions on taxation (RUU KUP).

"It is hoped that this would present a fairer and more inclusive international taxation system," she affirmed.

Related news: RI hopes int'l taxation deal secured under Italy's G20 presidency

Related news: Gas price adjustment for industry to boost tax receipts: ministry

Related news: Finance minister projects 2021 economic growth in 3.7-4.5 pct range

Translator: Astrid F, Azis Kurmala

Editor: Sri Haryati

Copyright © ANTARA 2021