European equity futures firmer after Trump delays EU 50% tariff deadline to July 9th; DXY below 99 & antipodeans benefit - Newsquawk Europe Market Open

- US President Trump announced a delay to the 50% tariff deadline on EU goods to July 9th.

- APAC stocks traded mixed as the initial uplift following Trump's announcement gradually waned.

- European equity futures indicate a higher cash market open with Euro Stoxx 50 futures up 1.6% after the cash market closed with losses of 1.8% on Friday.

- DXY has started the week on the backfoot and has slipped below the 99 mark, EUR/USD is on a 1.14 handle, antipodeans outperform.

- Trump called Russian President Putin "crazy" after Russia launched the largest air attack on Ukraine in the war so far despite the sides conducting a three-day prisoner swap.

- Looking ahead, the only notable highlight on the calendar is ECB's Lagarde. UK & US markets are closed.

- The desk will run to 18:00BST/13:00EDT on Monday 26th May, at which point the service will close due to holiday closures. The service will then re-open later that evening at 22:00BST for the beginning of the Asia-Pacific session.

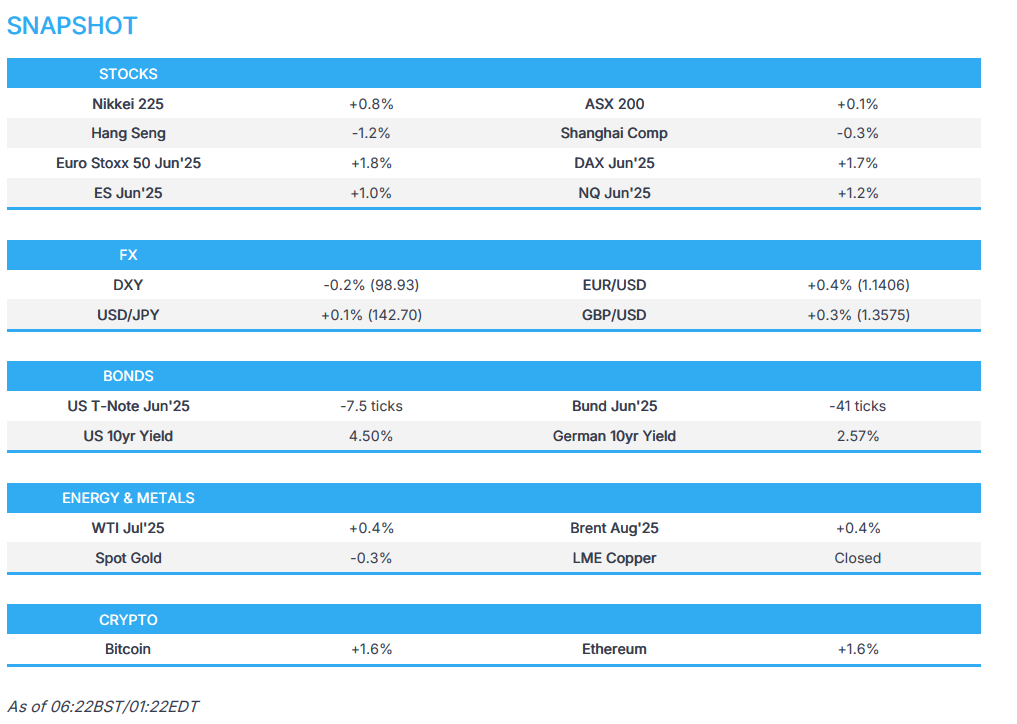

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

US TRADE

EQUITIES

- US stocks were pressured on Friday but finished off lows with selling triggered by US President Trump's tariffs threats after he touted a straight 50% tariff on the EU and noted that discussions with the EU were going nowhere, while Apple shares and the tech sector were hit after Trump also suggested at least 25% tariffs on Apple, Samsung and other smartphone manufacturers on phones not manufactured in the US. Nonetheless, the major indices clawed back a large chunk of their initial losses despite the lack of specific news catalysts for the partial recovery ahead of the long weekend due to the US Memorial Day and UK May Bank Holiday.

- SPX -0.67% at 5,803, NDX -0.93% at 20,916, DJI -0.61% at 41,603, RUT -0.28% at 2,040.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said he received a call from European Commission President von der Leyen requesting an extension on the June 1st deadline on the 50% tariff with respect to trade and the European Union and he agreed to the extension to July 9th, 2025, while he added that the Commission President said that talks will begin rapidly.

- European Commission President von der Leyen said she had a good call with US President Trump to discuss a trade deal and that the EU will need until July 9th to reach a good deal, while she added that Europe is ready to advance talks swiftly and decisively.

- Japanese top tariff negotiator Akazawa said the schedule for the next round of talks is still being arranged and he hopes to meet with US Treasury Secretary Bessent during the next round of talks.

- ASEAN Secretary General said China-ASEAN Free Trade Agreement 3.0 negotiations concluded which is to boost investment and trade, while the inaugural GCC-ASEAN-China summit is also to be held in Malaysia this week.

NOTABLE HEADLINES

- Fed Chair Powell refrained from making comments on the economic or policy outlook and urged university students to protect democracy in remarks at Princeton.

- Fed's Kashkari (2026 voter) said uncertainty is at the top of mind for Fed and US businesses, while he replied anything is possible when asked if the Fed will move by September. Furthermore, Kashkari said they are in wait-and-see mode and noted the shock of tariffs is stagflationary.

APAC TRADE

EQUITIES

- APAC stocks ultimately traded mixed as the initial uplift following US President Trump's announcement to delay the 50% tariff deadline on EU goods to July 9th, gradually waned, while price action was contained amid relatively quiet newsflow and in a holiday-thinned start to the trading week globally, with markets in the UK and US shut on Monday.

- ASX 200 lacked direction as strength in the tech and commodity-related sectors was offset by weakness in defensives and industrials.

- Nikkei 225 advanced but was off today's best levels amid headwinds from recent currency moves, while Nippon Steel shares were supported at the open after US President Trump backed a 'partnership' between Nippon Steel and US Steel.

- Hang Seng and Shanghai Comp were subdued with underperformance in Hong Kong amid weakness in automakers and tech amid ongoing US trade policy uncertainty and with the latter also pressured after China’s regulator published draft guidelines for fees online platforms charge third-party merchants.

- US equity futures (ES +1%, NQ +1.2%) advanced following US President Trump's announcement of a tariff deadline delay for the EU.

- European equity futures indicate a higher cash market open with Euro Stoxx 50 futures up 1.7% after the cash market closed with losses of 1.8% on Friday.

FX

- DXY was pressured and retreated beneath the 99.00 level as its major counterparts gained following US President Trump's announcement to delay the 50% tariffs on EU goods to the previous additional reciprocal tariff deadline of July 9th instead of June 1st, while newsflow was otherwise relatively light as Fed Chair Powell refrained from commenting on monetary policy and the economy during remarks at a Princeton University Baccalaureate event and with US participants on a long weekend due to the Memorial Day holiday.

- EUR/USD reclaimed the 1.1400 handle after US President Trump granted European Commission President von der Leyen's request for a tariff delay.

- GBP/USD took advantage of the weakness in the greenback although further upside was restricted with UK markets closed on Monday for a bank holiday.

- USD/JPY trickled lower as the pressure in the dollar fully offset the initial haven outflows from the yen.

- Antipodeans extended on last week's rally with the help of the early boost to risk appetite and after the PBoC set the strongest reference rate setting since early April.

FIXED INCOME

- 10yr UST futures retreated beneath the 110.00 level following US President Trump's announcement to delay the 50% tariffs against the EU and with demand also subdued amid the closure of cash treasuries trade on Monday due to the US Memorial Day holiday.

- Bund futures gapped lower at the reopening as havens were pressured owing to Trump's tariff deadline extension for the EU.

- 10yr JGB futures faded some of last Friday's after-hours gains alongside the positive risk mood in Japan but was later supported by firmer demand at the latest enhanced liquidity auction for longer-dated JGBs.

COMMODITIES

- Crude futures were rangebound amid a lack of major energy-specific catalysts and following mixed geopolitical headlines including comments from US President Trump who stated there were some very good talks with Iran and had some real progress, while Trump criticised Russian President Putin after Russia launched the largest air attack on Ukraine in the war so far despite the sides conducting a three-day prisoner swap.

- US plans a Chevron (CVX) licence for minimum maintenance in Venezuela, according to Bloomberg.

- Libya’s NOC said an oil leak occurred in a crude oil pipeline south of Zawiya City and production through the affected pipeline immediately halted.

- Spot gold mildly eased back from last week's peak as risk appetite was boosted shortly after the reopening of futures trading due to President Trump's announcement to postpone the 50% tariffs on Europe to the previous July 9th reciprocal tariff deadline instead of the June 1st deadline which had just touted on Friday.

- Copper futures mildly extended on Friday's upward momentum amid a weaker dollar but with further gains capped amid the somewhat mixed risk appetite in Asia-Pac.

CRYPTO

- Bitcoin was choppy overnight but ultimately edged higher after returning to above the USD 109k level.

NOTABLE ASIA-PAC HEADLINES

- Chinese Premier Li said in a meeting with Indonesia’s President that China and Indonesia will expand cooperation in finance, new energy, digital economy, AI, aerospace and marine industries, while he added that China is willing to deepen cooperation with Indonesia in food, agriculture, poverty reduction and health, according to Xinhua.

- China's MOFCOM created an action plan for accelerating the digital intelligence supply chains in agriculture and manufacturing, as well as promoting a reduction of logistics costs.

- NVIDIA (NVDA) is to start mass production of a new China Blackwell chip as early as June and will launch the new AI chipset for China with Blackwell architecture priced at USD 6,500-8,000, according to sources.

- South Korean presidential frontrunner Lee said an extra budget will be needed to boost the economy in the short-term, while he added that heightened military tensions with North Korea are burdening South Korea’s economy and that a deadline on tariff talks with the US should be reconsidered.

GEOPOLITICS

MIDDLE EAST

- US Secretary of Homeland Security Nielsen met with Israeli PM Netanyahu and expressed Washington's unconditional support for Israel.

- US President Trump said the US had some very good talks with Iran and had some real progress.

RUSSIA-UKRAINE

- Russia and Ukraine completed a three-day prisoner exchange involving 1,000 prisoners from each side.

- Russian Defence Ministry said Russia took control of Loknia, Stupochki, Itradne and Romanivka in eastern Ukraine, according to RIA.

- Ukraine’s Air Force said on Saturday that Russia fired 14 ballistic missiles and launched 250 drones overnight on Ukraine, while Ukraine said on Sunday morning that Russia attacked it with 367 missiles and drones overnight. It was also reported that Russia downed 110 Ukrainian drones overnight including 13 over Moscow and Tver region.

- Ukrainian President Zelensky said the overnight Russian bombardment shows to the world that Moscow is the reason the war is being dragged out and only new sanctions on Russia will force Moscow to agree to a ceasefire.

- US President Trump said he is not happy with what Russian President Putin is doing, killing a lot of people, while he is absolutely considering more sanctions on Russia.

- US President Trump posted on Truth "I’ve always had a very good relationship with Vladimir Putin of Russia, but something has happened to him. He has gone absolutely CRAZY! He is needlessly killing a lot of people, and I’m not just talking about soldiers. Missiles and drones are being shot into Cities in Ukraine, for no reason whatsoever. I’ve always said that he wants ALL of Ukraine, not just a piece of it, and maybe that’s proving to be right, but if he does, it will lead to the downfall of Russia! Likewise, President Zelenskyy is doing his Country no favors by talking the way he does. Everything out of his mouth causes problems, I don’t like it, and it better stop."

- US envoy to Ukraine said Russia’s attack on Kyiv is a clear violation of the 1977 Geneva peace protocols.

- German Foreign Minister Wadephul said the massive Russian attack demonstrates that Russian President Putin is not interested in peace and stated that they must react with additional sanctions on Russia.

OTHER

- German Chief of Defence ordered the German military to be fully equipped with weapons and other materials by 2029, making use of funds available after loosening the constitutional debt brake.

- South Korea’s Foreign Ministry expressed concern to China about its setting a no-sail zone in a provisional maritime area.

- North Korea said its damaged warship is under repair, according to KCNA. It was separately reported that North Korean officials were arrested after a warship blunder 'brought dignity of country to collapse', according to Sky News.

EU/UK

NOTABLE HEADLINES

- Moody’s affirmed Italy at Baa3; Outlook revised to Positive from Stable.