Travis County Commercial Property Assessments Show Staggering Increases

There is a huge disparity between rising commercial property assessments and declining Green Street Commercial Property Price Index®

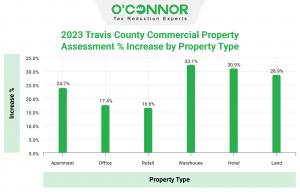

AUSTIN, TEXAS, UNITED STATES, April 21, 2023/EINPresswire.com/ -- Travis County assessment increases are not limited to single-family homes. Commercial property assessments have also seen staggering increases. According to the Green Street Commercial Property Price Index, published April 6, 2023, commercial property values have declined by 15%, but Travis County property values are up over 23%. This is a disparity of more than 38%.Escalating commercial property values are not limited to any specific property type, but are evident across the board, however warehouses, hotels, and land are most impacted with assessments ranging from around 29 to just over 33%.

When reviewing assessments according to year built, properties built prior to 1960 have the most significant increase at 32.8%, but more recent builds are also among the largest increase in assessment at over 25%.

Office properties present a slight defiance to the over all trend of increase by year built with properties constructed in 2001 and more recently showing the greatest increase at 20.8%. The next highest increase among office properties is 20.3% with property built between 1961 and 1980.

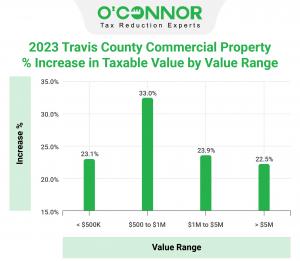

All Travis County commercial property is assessed significantly higher for 2023, with all value ranges showing more than 22% increase, however property in the value range of $500K to $1M is the most impacted at an amazing increase of 33%.

Travis County apartments built before 1960 are outrageously assessed at value increases over 49% and similar to apartments, retail properties also show the greatest increase in assessed value for property built prior to 1960.

When comparing the various types of commercial property with a focus on the year built, warehouses constructed pre-1960 have astronomically higher assessed value increases at 87.5%. This is more than double the percent increase for the next highest year-built range of 2001 to present.

Travis County offices range from a 15.4% increase in assessed value for high rise properties to a 24.8% jump in assessed value for low rise properties. Apartment increases in assessed value seem to be opposite the pattern set by office properties, where high rise apartment property values are the most inflated with an increase of over 25%, while small apartments and mid-rise apartments have increased by 19.1% and 18.4% respectively.

Among retail, single tenant properties have shown the most substantial surge in assessed value with a 27.6% increase.

Commercial warehouse properties have increased from just over 11% to as high as more than 40%, depending on sub-type.

Commercial property owners in Travis county can expect to see significant increases in their property taxes unless they exercise their right to appeal and record levels of property tax protest are expected to follow. The deadline to file a property tax protest is May 15th.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Visit O’Connor at www.poconnor.com or call 713-290-9700.

Patrick O'Connor, President

O'Connor

+1 713-375-4128

email us here

Distribution channels: Banking, Finance & Investment Industry, Building & Construction Industry, Business & Economy, Consumer Goods, Real Estate & Property Management

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release